Have A Side-Hustle? You Need This Spreadsheet To Track Earnings And Expenses

The past few years, I’ve tracked hundreds of thousands of dollars through one single spreadsheet.

Want to see it?

Boom.

I remember early 2019 when I first created this spreadsheet. The year before*, my online course business blew up and I had no idea how much money I was making every month from all my different side hustles.*

Youtube ad revenue, Facebook ad revenue, online courses, oh my!

I was flying blind, and one simple spreadsheet helped me consolidate thousands of dollars overnight.

Let’s break down the spreadsheet, how it works, and how you can get your own copy.

Earnings, Expenses, And Investments

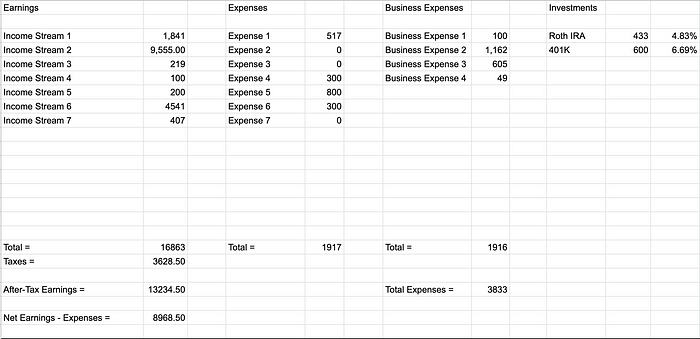

The top of my personal finance spreadsheet is divided up into four buckets: earnings, expenses, business expenses, and investments.

As a solopreneur, I need to calculate my business expenses so I can subtract it from my taxable income at the end of the year. All the numbers you see above are random, by the way. They’re not mine.

I like to also track how much money I’m investing. If you invest in a ROTH IRA, you can subtract that money from your taxable income at the end of the year, too.

Beneath all these columns are “Total” buckets. I do a simple formula in my Google sheet that automatically adds all my earnings, expenses, and business expenses below each column.

So if you want to copy this spreadsheet, you can just add as many income streams as you need beneath Income Stream 7.

Obviously, just rename all of these as you see fit. “Freelancing Work” could be one of them, or perhaps “Youtube Ad Revenue” could be another.

Let’s pause for a second. There’s probably a sliding scale of folks reading with some on the “self-employed” end, and some on the “Employed” end.

I will give you a few different spreadsheet variations for you to download if that’s the case so you can benefit from my super barebones (yet awesome) sheet.

Total Up Your Income For Maximum Analytical Prowess

Now let’s talk about the bottom part of this spreadsheet, which is where the fireworks really fly.

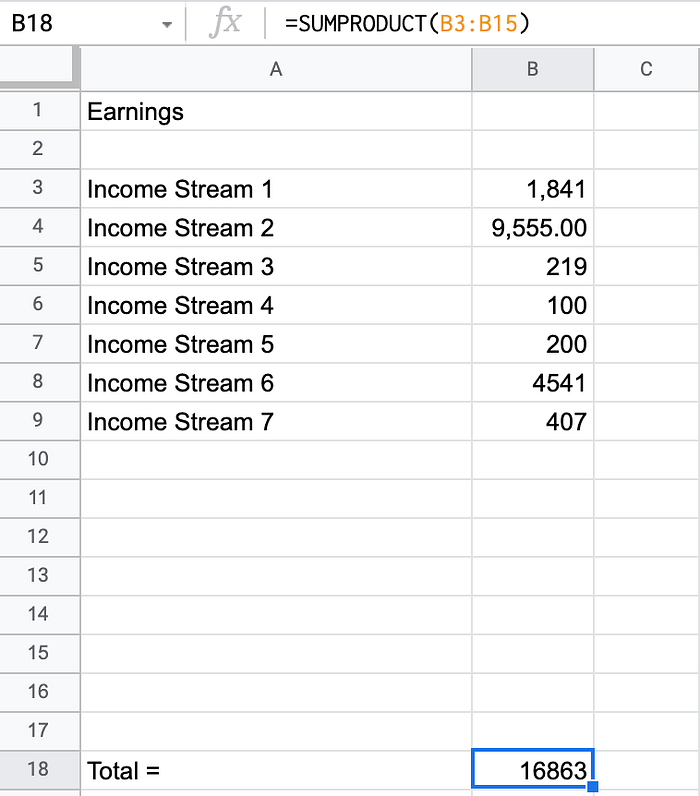

Let’s take a look at the formula for taxes, located in the cell B19.

So basically you take your Earnings (B18) and subtract your Business Expenses (H18) and any Investments into Roth accounts (K3) from that. That’s your taxable income. Then you multiply it by .25 to get the amount of money you need to sack away for tax season.

Since I’m self employed, I actually owe the government money at the end of the year. Because of that, I need to know how much to save. I always save 25% of my gross revenue just in case.

It’s NEVER been a 25% tax rate for me yet (not even close), but I still like to do that to be prepared.

Then I calculate my After-Tax Earnings (B21), which is just my Gross Revenue minus my tax burden.

That’s sort of my actual income.

Now, If you draw your eyes to the right of this spreadsheet, you’ll see I’ve added up my business and personal expenses in cell H21.

For my final act, I simply subtract my After-Tax earnings from my Total Expenses, to see how much I have leftover. That happens in cell B23.

Notice how I also subtract the money I invested. Cells K3+K4 are my investments, and I make sure to subtract them, too.

And there you have it, a sum of money that’s either positive or negative showing whether you spent more than you made, or made more than you spent.

It’s all I really need to be honest with you.

Want To Copy This?

Here you go. It’s yours.

I typically copy and paste this sheet 12 times for one calendar year, keeping track of each month’s income streams and expenses.

Keep in mind that this design is mine, too. I didn’t copy this from anybody. I don’t even know what these typically look like. I just created something that worked for me.

If you’re not 100% self-employed, but do some side-hustle work, perhaps you can delete the “Expenses” and “Investing” column from this spreadsheet and only focus on your side hustle earnings and business expense tracking.

Everything stays the same — all the formulas.

Then if you want to also use this for your own personal finance journey outside the side hustle stuff, then copy this version. It looks like this:

It’s super bare bones, so I’m sorry about that, but I wanted to give something to everybody.

Let me know if you have any problems copying this below in the comments.