I Invested $10,000 Into A Failing Crypto Market — Here’s 5 Lessons Learned

Just another day in Bitcoin.

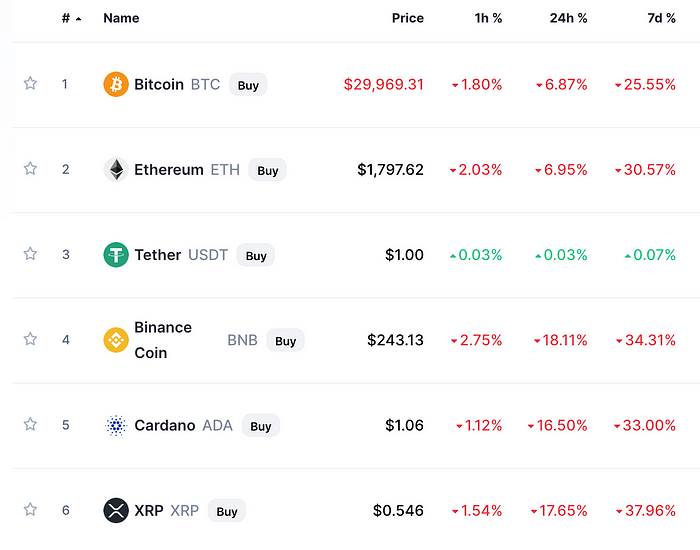

It’s June 22, 2021 at 8:04 AM as I write this. Bitcoin’s slipped beneath the $30,000 mark for the first time since January 1 of this year. It’s been a crazy bull market for the last 8 months or so, but it seems as if momentum is fizzling out.

Bitcoin is down 25% in the last 7 days. Ethereum is down 30%, and most of the other cryptocurrencies are down as much, too.

I’ve lost some $4,000 in the value of my $10,000 portfolio right now, and to be honest with all of you, I’m not really that worried.

I’d buy more right now if I was sure this is the bottom, but I don’t think the bottom is anywhere in sight.

One of my more ridiculous trades in the last two months was buying $1,000 worth of Ether at the absolute top a month and a half ago.

That was a hilarious trade in hindsight, but I thought it was going up to $6,000 so you can forgive me.

The point is, I’ve made a lot of mistakes in this market and I have a little bit of skin in the game so far with $10,000+ invested.

Here’s 5 lessons for you if you’re someone who wants to invest in crypto, too.

1. We’re Still Very Early

A few weeks ago, El Salvador became the first country IN HISTORY to accept Bitcoin as legal tender. A tweet from Elon Musk sends crypto prices plummeting. Bitcoin has $10,000 price swings in the span of a week.

I used to think that I missed the boat on cryptocurrency. I used to think that I should’ve bought Bitcoin at $3,000 back in 2017 when I had the chance.

After seeing the enormous volatility that still exists in the market, and how widespread crypto adoption really hasn’t happened yet, I believe we’re still in the “minutes after birth” stages of this game.

2. There Really Hasn’t Been A Whole Lot Of Bull Markets

In the back half of 2017, Bitcoin surged in price from $1,578 on May 5 to $19,140 on December 16.

Then the bottom fell out.

Bitcoin started 2018 at the $15,000 price point and ended the year just below $4,000.

Then from mid-2019 to mid-2020, the price basically stayed the exact same, then it dove off a cliff when the pandemic happened.

And now, well, we all know what happened over the last year.

Crypto markets skyrocketed, which pulled me into wanting to learn more about Bitcoin and crypto at large. And now I look like the moron who invested basically everything at the very top of the market.

I realized one thing when looking at past data and analyzing Bitcoin’s price over time..

You really need to make hay every 3–4 years when the Bitcoin halving occurs. When the halving happens, you can expect the price to rocket in value like a Coke and Mentos reaction.

When there’s not a halving occurring, it seems the opportunity to make money in this market is non-existent, because price just meanders sideways until the next halving.

I think this game rewards people who have been in it for 3–4 years (at least), and if I need to stay on the sidelines, invest more, and wait for the next Bitcoin halving to make hay, then I will.

3. You Need To Pay The Price To Get A Reward In The Marketplace

I was reading The Psychology Of Money the other day by Morgan Housel, and he had a very important investing lesson I’ve never thought of before.

He writes:

“Like everything else worthwhile, successful investing demands a price. But its currency is not dollars and cents. It’s volatility, fear, doubt, uncertainty, and regret — all of which are easy to overlook until you’re dealing with them in real time.”

He then goes on to criticize day traders and people who try to “time the market” to escape this price you have to pay to get real returns.

He writes about how Morningstar once did a study on the performance of tactical mutual funds in 2010 and 2011, when the U.S. stock markets were soaked in fear of a new recession. Their strategy was to switch between stocks and bonds at opportune moments in order to “avoid” the price of the market.

Only 9 out of 112 tactical mutual funds studied had a higher return than a simple 60/40 stock-bond fund.

In other words, 90% of these tactical mutual funds failed to outperform a simple stock-bond fund.

When you try to avoid the “price” of the market by timing it, you end up losing more than folks with steadier investing strategies.

Here’s the punchline: You need to go through market declines to reap the rewards. Every market has a price. That price is fear, volatility, uncertainty, and regret. If you’re willing to pay that price, and stick with the game long-term, you’ll have a higher chance of winning.

4. It Doesn’t Matter What Price Bitcoin Is — What Matters Is Accumulating It

Bitcoin, right now, is sitting at about $28,900 in price. That’s right, it’s declined $1,000 in the hour I’ve spent writing this article.

Detach Bitcoin from its price in USD, though.

Think about Bitcoin in terms of how much you actually have.

Do you have 1 Bitcoin? Do you have 1/4 of a Bitcoin? Are you a whale who has, like, 1,000+ Bitcoins?

I’m confident that one day we’ll see all types of goods and services priced in Bitcoin, not USD.

Let’s do the other half of this thought experiment..

What will Bitcoin’s price be in five years?

Do you think it will be higher or lower than it is right now?

If history’s told us anything, Bitcoin will have a meteoric price increase set off by the next halving. I’m pretty confident that whatever price I buy Bitcoin at today will be dwarfed by its price in USD 5 years from now.

I like lower prices because it means I get to accumulate more Bitcoin and other cryptocurrencies like Ether for a lower price.

5. Stop Checking The Price Every Day If You’re Playing A Long-Term Game

I got obsessed with cryptocurrency recently. For the last two months, I’ve been checking the prices every single day.

It’s really stupid to do this.

For one, I kind of got obsessed. Two, if I plan to hold all this stuff for years or maybe even decades, why do I care whether the price of Bitcoin fluctuated a few thousand dollars this week?

I think I got into this bull market a little late. That’s fine. I get to pay the price for that over the next few years, perhaps.

This is the price I pay for only paying attention to cryptocurrency when it’s going through a meteoric rise in price.

I’m not going to get rich anytime soon. If I continue socking money into crypto markets, though, for the next few years, I might be able to make a killing when the next bull market comes around.

Whenever that will be.

But this was always a long-term play for me. I got caught up in the crypto hype thinking this wasn’t the end of the bull market. It seems like it is, unfortunately.

Now I get to sit in hibernation, accumulate more crypto, and wait for the next moon launch to occur, whenever that will be. I hope Elon tweets a lot more so the price gets absolutely hammered.