Want To Be A Millionaire In 15 Years? Here’s How Much You Need To Invest

‘Damn!’ I thought.

As I crunched numbers on Dave Ramsay’s Investment calculator, I realized you could stream roll to a million dollar portfolio with a relatively low monthly investment.

Just how low? And how many years would it take you?

Let’s take guesses.

$500 monthly?

$1,000 monthly?

$2,000 monthly?

$5,000 monthly?

Vote now on your phones.

Let’s say you’re 25 years old and want to retire by the time you’re 40 (good for you), how exactly would you accomplish that? Since this is the Post-Grad Survival Guide, let’s get into it.

What’s The Magic Number?

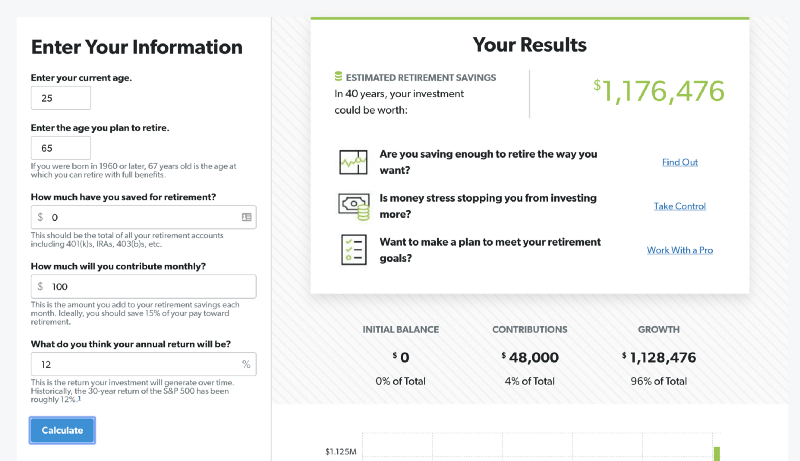

This is Dave Ramsay’s Investment Calculator. It’s pretty nifty. Here you’ll see I can input my current age, the age I want to retire, how much I have saved for retirement, and how much I’m willing to contribute monthly.

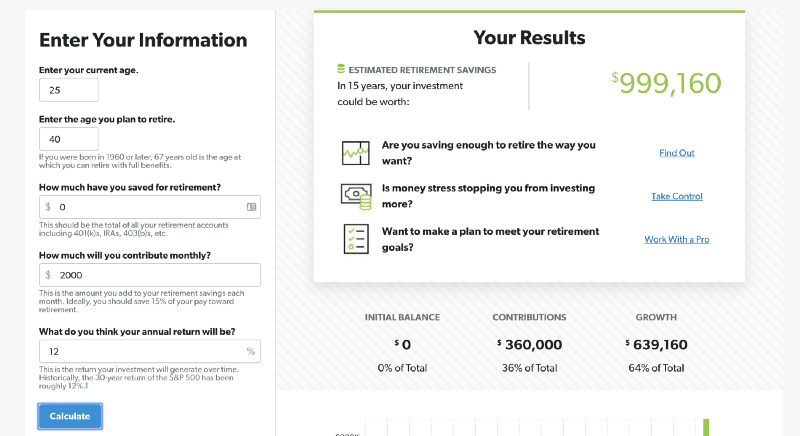

Let’s assume you’re 25 and have $0 invested at the moment.

Before we reveal the winner, let’s talk about the results for each monthly amount I mentioned above.

If you invest $500 monthly and we assume a 12% return on investment every year, which is typical for the stock market, you’ll end up with $249,000.

If you invest $1,000 monthly for fifteen years, you’ll end up with $499,000.

And now, for the grand finale, if you invest $2,000 monthly for fifteen years, you’ll eclipse the $999,000 mark.

I know it’s not quite a million dollars, but I have a nice whole number in $2,000 here so please get off my back.

Let’s take a look at $5,000 invested monthly just for shits and giggles.

Welp, if you managed to invest $5,000 monthly into the stock market for 15 years, you’ll have a cool $2.5 Million by the time you’re 40.

Enjoy your retirement. And your Rolex watches.

Let’s Take A Closer Look At The Growth

Having a million dollars in your portfolio after fifteen years is like sprinting a marathon.

I get it, it’s fucking difficult to get here and you’re probably not going to be able to retire by 40 years old. Me neither. It’s just fun to ponder how money works.

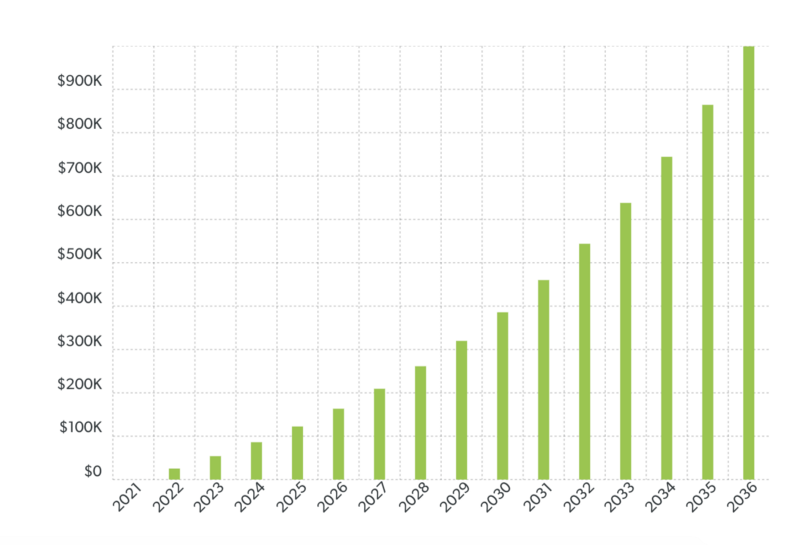

Based on the graph above, it takes four years to cross the $100,000 threshold, and most of that money is literally just the cash you threw into the stock market. You’ve invested $96,000 and have $122,000. Your money has really only made you $26,000 so far.

Not bad, but not amazing (yet).

Two years later you’ll cross $200,000, ending the year with about $209,000. That’s incredible because it took us four years to get to the first $100,000 marker.

In 2032, you’ll surpass the unbelievable half a million dollar mark, a full 11 years after you started investing.

Then, by 2036, in just four years, your portfolio will make you another half million dollars to put you at $999,000.

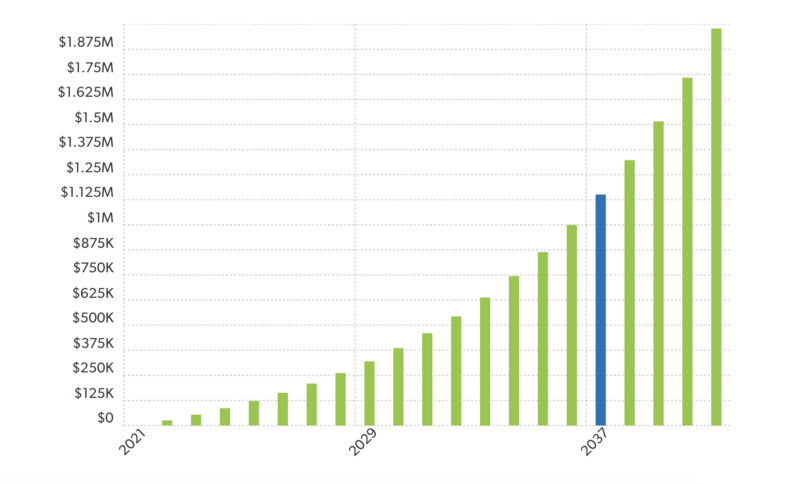

Obviously this is compound interest in action. It took you 11 years to get the first half a million dollars, and four to get the second half million. Let’s extend the graph out by 5 years just for the hell of it.

Congratulations, you’ll have $2,000,000 in your portfolio by the time you’re 45 if you stick with it another 5 years. 15 years to get the first million. 5 years to get the next million.

It’s raining diamonds up in here.

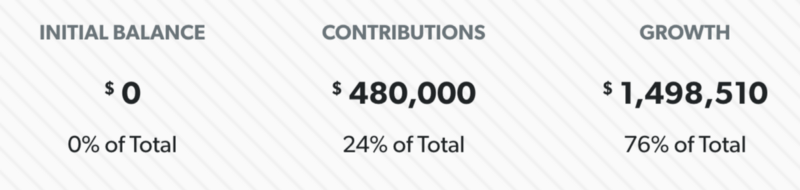

In fairness, in this 20 year plan example, we’ve invested a ridiculously large sum of money — $480,000 to be exact.

However, our money’s grown by $1.5 Million.

How To Get Started Investing

It’s not that hard to get started with investing in the stock market. Don’t let this graph pressure you. Let’s say you want to have $1,000,000 by the time you’re 60 years old, and you want to start right here at age 25. The good news is, this is more than doable..

If you invest just $100 every month from now until the time you’re 60, you’ll have over $1,000,000 in the bank. I did an experiment and tried out $500 monthly, and I ended up with over $5,000,000.

It’s pretty awesome to test different amounts of money — I’ve found it can make you stress a hell of a lot less about your personal finances.

For me, I got started investing with Vanguard. I opened an IRA two years ago and have been able to max it out every year (it has a $6,000 contribution limit).

I normally just buy their VTSAX fund, or Total Stock Market Index Fund. That means I’m investing in a fund that basically replicates whatever the stock market does.

I’m not an expert on personal finance/investing, but I have read a bunch of books about it from the experts and this is basically what they tell you to do.

Wrap Up

Remember this about the stock market, and remember none of this is sanctioned financial advice.

- It takes investing $2,000 per month to make $1,000,000 in 15 years.

- If you invest just $100 per month, you can have $1,000,000 in 35 years.

- Use Vanguard to get started investing.

- Take a look at Vanguard’s VTSAX fund if you want a hands-off investment option.